Amazon flex address for taxes.

Sydney, New South Wales. Our Sydney pick-up locations are located in: • Regents Park (DNS2) • Botany (XNS1) • Bella Vista (DNS4) We are currently only looking for Large Passenger Vehicle and Cargo Van delivery partners in Sydney. Sedan drivers can download the app and create an account to join our waitlist.

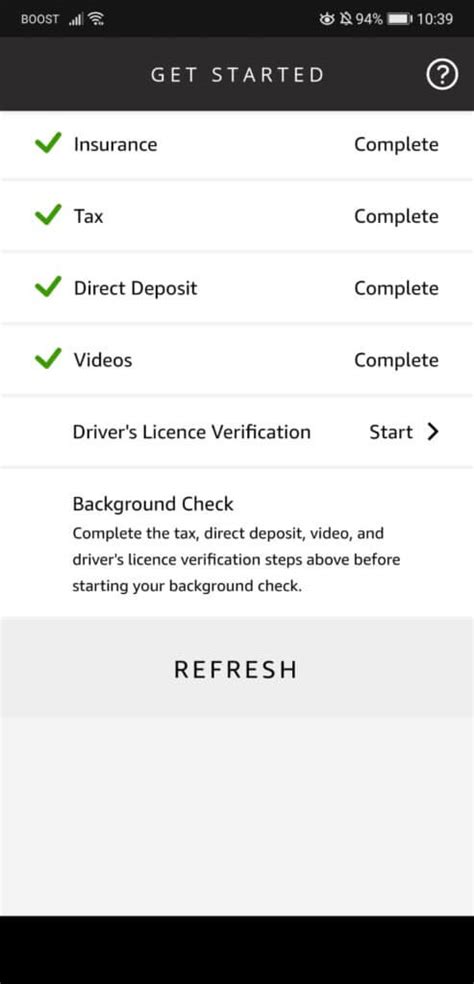

Download the Amazon Flex app. Becoming an Amazon Flex delivery driver is easy. Simply scan the QR code on the right using your iPhone or Android camera, and you will be directed to the download process.But I also just did my taxes, and for whatever it's worth my Flex income info for 2019 came on a "1099-MISC" form, with Amazon's address listed as PO Box 80683 Seattle WA 98108. But as I said above, this is NOT needed to apply as a gig worker.Self Employment tax (Scheduled SE) is automatically generated if a person has $400 or more of net profit from self-employment. You pay 15.3% SE tax on 92.35% of your Net Profit greater than $400. The 15.3% self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.How to download the Android app for Amazon Flex. Why Flex Let's Drive Safety Locations FAQ Rewards. EN. HI. Amazon Flex for Android. How to download the Amazon Flex app on Android. prev next. Step 5: Create your Amazon Flex account. Once you've installed the Amazon Flex app, you can create your account. The Amazon Flex app will guide you …

But I also just did my taxes, and for whatever it's worth my Flex income info for 2019 came on a "1099-MISC" form, with Amazon's address listed as PO Box 80683 Seattle WA 98108. But as I said above, this is NOT needed to apply as a gig worker.Amazon just gets to avoid paying more taxes. Across the pond in the UK Amazon only paid £4.6 million in taxes in 2017, by routing sales through Luxembourg, a well known tax haven. Almost 75% of Amazon’s 2017 UK revenue, amounting to £6.88bn of UK sales, was registered through their Luxembourg subsidiary.

With Amazon Flex, you can earn on your terms with offer types that fit your life and goals. Most drivers earn $18-$25 an hour, and there are two main ways to earn with Amazon Flex: “blocks” that you can schedule in advance, and “instant offers,” which are deliveries that start right away.

Christian Davis Updated February 16, 2022 Reviewed by a tax professional As long as you have a car and a smartphone, delivering packages through Amazon Flex is a great way to make some extra cash. You can even do it on the side of a day job! At tax time, though, your life can get pretty complicated.February 16, 2022 Reviewed by a tax professional As long as you have a car and a smartphone, delivering packages through Amazon Flex is a great way to make some extra cash. You can even do it on the side of a day job! At tax time, though, your life can get pretty complicated.Sydney, New South Wales. Our Sydney pick-up locations are located in: • Regents Park (DNS2) • Botany (XNS1) • Bella Vista (DNS4) We are currently only looking for Large Passenger Vehicle and Cargo Van delivery partners in Sydney. Sedan drivers can download the app and create an account to join our waitlist.Use the total earnings in your Amazon Flex App for the previous calendar year (January 1st to December 31st) Amazon Flex EIN: 91-1646860; Amazon Flex …

You can get an Amazon Flex pay stub in one of three ways: Use the Amazon Flex app: If you’re using the app to drive for Amazon Flex, you can see all your earnings, including your pay stub, on the app. However, you won’t have a pay stub if you only use the app to find out where to pick up assignments. Call Amazon Flex: If you’re picking up ...

Rule of thumb: Receipts aren’t strictly required as long as the expense cost less than $75. That’s true even if you pay with cash, which means you won’t have a credit card or bank statement to corroborate your purchase. You still won’t necessarily need your receipt, provided your expense is “reasonable and ordinary.”.

Full list of the 35 Amazon Flex Warehouses & Delivery Locations near Seattle, WA RWA4 - Seattle 909 5th Ave, Seattle, WA 98164 Location is approximate Show on Map UWA3 - Seattle 2121 8th Ave., Seattle, WA 98121 Show on Map UWA4 - Seattle 76 ...We would like to show you a description here but the site won’t allow us.With the Amazon Flex app, you’ll be able to see how much you’ll earn for each delivery - all before your delivery block begins. Once you’ve completed a delivery, track your payments with ease from the ‘Earnings’ page. Learn more about Amazon Flex earnings, frequency of payments and how you can change your bank details below.You can deduct all mileage once you first arrive at work. For Flex, this means everything from pickup (when you first arrive) through your last stop (when you start to go home, whether this is last delivery or from depot). Definitely use a …Oct 8, 2023 · It’s a progressive tax, which means that the amount of tax you’ll owe depends on your income bracket. For example, if you’re in the 24% tax bracket and earn $50,000 from Amazon Flex, you’ll owe $12,000 in federal income taxes ($50,000 x 0.24). In addition to the federal taxes that we just discussed, you’ll also need to pay state taxes. Mar 26, 2021 · In Southern California’s four-county region, consumers spent an estimated $12.5 billion buying goods just through Amazon last year, up almost 38%, according to a separate analysis by the ...

Amazon Flex doesn’t take out taxes on your behalf. Amazon Flex drivers are self-employed. They are responsible for paying their taxes at the end the tax year. Amazon will issue a 1099 to Flex Drivers. From there, it is the individual’s responsibility. All American taxpayers have a constitutional obligation to pay income taxes, no matter how ...Use the total earnings in your Amazon Flex App for the previous calendar year (January 1st to December 31st) Amazon Flex EIN: 91-1646860; Amazon Flex …But as a delivery driver, you are considered a tradeperson and as such, you need to pay income tax if your earnings exceed the tax free threshold. Related ...Amazon FAANG Online shopping S&P 500 Consumer discretionary sector Marketplace and Deals Marketplace Business Website Finance Business, Economics, and Finance Information & communications technology TechnologyThe Amazon Flex website says you can earn between $18 and $25 per hour. And that is very enticing if you are looking to make some extra money. And according to some drivers, you can earn even more than that if you deliver your packages quickly, since Amazon pays you per block, rather than per delivery.Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.To file taxes for Amazon Flex, you will need to report your earnings as self-employment income on your tax return. This means you will need to file a Schedule C …

T: 1800 290 564. E: [email protected]. Available 8 AM to 11 PM AEST daily. As an Amazon Flex delivery partner, you can use your own sedan, large vehicle or van to deliver Amazon packages.Misaki Thermal Printer Rolls, Labels Stickers for Amazon Flex, Sticky Labels 4" x 6" Direct Thermal Shipping Label Rolls Address Stickers Compatible with TSC, Zebra Printers (250 Labels, 2 Roll) : Amazon.in: ... Inclusive of all taxes: Brief content visible, double tap to read full content. Full content visible, double tap to read brief content. Offers. Previous page. …

Make £13-£17* an hour. Amazon Flex pays in hourly blocks. When you schedule a delivery block, you’ll know the estimated duration and how much you can earn* - all before your delivery block begins. You can build your own schedule - there are usually delivery blocks available seven days a week. However, the available delivery blocks may ...An MSA is a tax-free account that allows you to pay for expenses with pretax money. You can set aside money for eligible expenses before your employer deducts taxes from your paycheck. This means the amount of income on which your taxes are based will be lower. Here’s an example: With MSA Without MSA Annual income $50,000 $50,000We would like to show you a description here but the site won’t allow us.Provide tax and payment details. ... Sign in to amazon.com.au using the email address and password that is currently associated with your Amazon Flex account.Amazon Flex offers delivery drivers the freedom and flexibility to be their own boss. The average delivery driver can earn from $114* for a 4 hour delivery block. With the Amazon Flex app, you’ll be able to see how much you’ll earn for each delivery block - all before your delivery block begins. Once you’ve completed a delivery, track ...Getting Started. The interview is designed to obtain the information required to complete an IRS W-9, W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or 1042-S reporting. In order to fulfill the IRS requirements as efficiently as possible, answer all questions and enter all information requested during the ... Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.Go to Snapshot Working at Amazon Flex Browse Amazon Flex office locations. Amazon Flex locations by state. 3.4. California 3.4 out of 5 stars. 3.3. Texas 3.3 out of 5 ...

If you’re an Amazon Flex customer anxiously awaiting a package, there’s one phone number you need to know. Call 1-877-212-6150 to reach customer support regarding a pending order or pending delivery. The Amazon Flex support team is great when it comes to dealing with immediate issues regarding package deliveries.

After taxes and fuel costs you'll be left with maybe £6 per hour, if you put ... Amazon Flex reviews by location. London · Croydon · Manchester · Belfast · Stoke- ...

In todays video, I wanted to share with you guys how to file a tax return if you are self-employed. As an Amazon Flex, DoorDash, Uber Eats, Grubhub or any other …Follow the instructions for two-step verification . Under My Account, click Tax Information. Click View/Provide Tax Information. Scroll down to the "Year-End Tax Forms" section. Click Find Forms. Click Download. Go to taxcentral.amazon.com . Use your KDP account sign-in and password. Click the Find Forms button.According to Ridester, all Amazon Flex income is taxable—including tips—and it all needs to be reported. Ridester also …As of April 2014, Flex shampoo is still produced by Revlon, although many varieties of Flex have been discontinued. Few stores carry the brand; however, it is available online at Amazon.com.WoW Party Studio Flex Personalized Frozen Elsa Theme Birthday Party Background Banner with Birthday Boy/Girl Name (Multicolour, 4ft Height x 5ft Width) 17. Great Indian Festival. ₹504. M.R.P: ₹760. (34% off) Get it by Sunday, 15 October. Ages: 6 months and up.Making quicker progress towards your goals starts with downloading the Amazon Flex app. Android users: please refer to this FAQ. Start earning. Most drivers earn SGD$21-26 an hour. * Terms and conditions apply. Earnings estimates are based on delivering a number of packages across an estimated length of time (referred to as a block), completed ...As an independent contractor, you will use the information on form 1099 from Amazon Flex to complete Schedule C and Schedule SE, which in turn are needed to complete sections of Form 1040 that pertain to your Amazon Flex earnings and tax amounts. Below is an example 1099 form with total earnings of $5500 noted in BOX 7.To find an Amazon Flex location near you, visit our Locations page to see the full list of regions, towns and cities with Amazon Flex depots. We regularly update the list of areas where we are onboarding more delivery …With Amazon Flex Rewards, you earn points by completing blocks and making deliveries. When you schedule an offer in the Amazon Flex App (reserved offer, instant offer, etc.) you’re scheduling a block—a specified amount of time you will make deliveries with Amazon Flex. You will earn a minimum of 10 points for each block you complete.Making quicker progress towards your goals starts with downloading the Amazon Flex app. Android users: please refer to this FAQ. Start earning. Most drivers earn SGD$21-26 an hour. * Terms and conditions apply. Earnings estimates are based on delivering a number of packages across an estimated length of time (referred to as a block), completed ...To file taxes for Amazon Flex, you will need to report your earnings as self-employment income on your tax return. This means you will need to file a Schedule C …

Jul 24, 2023 · FTC RETURNS UNPAID TIPS TO AMAZON FLEX DRIVERS. The FTC is sending checks to more than 9,000 Amazon Flex drivers who had their tips withheld by Amazon between 2016 and 2019 and are still owed a payment from the 2021 settlement between the FTC and Amazon. In November 2021, the FTC sent payments to more than 140,000 Amazon Flex drivers totaling ... If you participated in Amazon Flex and received payments, you should have received a 1099-Misc form from Amazon. However, if you didn’t receive one, you can call them and request one. You can get a copy of your W-2 from your employer as well. The same goes for 1099-INT or 1099-DIV from your banks.13MP primary camera with 5 element lens, f/2.0 aperture, PDAF supported and 5MP front facing camera. 12.7 centimeters (5-inch) capacitive touchscreen with 1280 x 720 pixels resolution and 293 pixel density. Android v6.0.1 Marshmallow operating system with 1.4GHz Qualcomm snapdragon 435 octa core processor, Adreno 505 GPU, 4GB RAM, 64GB …Team Beem Blog Taxes Guide To Amazon Flex Taxes For Delivery Drivers Amazon Flex delivery drivers are classified as an independent contractor and not an employee. So, Amazon may not take care of withholding for you. Here's a detailed guide to help you file taxes in 2023. In this article Filing Taxes As An Amazon Flex Delivery DriverInstagram:https://instagram. gasbuddy xenia ohioitalian urban slangayr montgomeryvilleform 8958 Your account status appears in the “Product Status” box on the top left of the screen. If you see Active next to Amazon Pay in the Product Status box, then your tax interview has been successfully completed and you are all set to transact. If you see " REGISTRATION_INCOMPLETE ", your tax interview data is still being processed. Please wait ... how to increase your snapchat score by 1000trumbull county ohio obituaries FTC RETURNS UNPAID TIPS TO AMAZON FLEX DRIVERS. The FTC is sending checks to more than 9,000 Amazon Flex drivers who had their tips withheld by Amazon between 2016 and 2019 and are still owed a payment from the 2021 settlement between the FTC and Amazon. In November 2021, the FTC sent payments to more than 140,000 Amazon Flex drivers totaling ...We would like to show you a description here but the site won’t allow us. time to do some sketchy Maximize your earnings with Amazon Flex Rewards. With Amazon Flex Rewards, you earn points by making deliveries. As you earn more points, you’ll level-up and gain access to new rewards. You’ll have access to exclusive discounts on a wide range of categories like gas, roadside assistance, and car maintenance, in addition to cash back on ...SECUREMENT® Direct Thermal Label Rolls Address Stickers for Ecommerce Shipment and Sellerflex (4"x6" inch) - 100mm x 150 mm (500 Labels Roll, 6 Rolls) : Amazon.in: Office Products Skip to main content.in. Hello Select your address Office Products. Select the department you want ... Self Adhesive Stickers useful for seller flex sites and other …