Amazon flex address for taxes.

Directors. Below is a summary of our committee structure and membership information. To read more about any of the committees, click on committee names in the chart below.

Jabra Evolve2 65 Link380a MS Bluetooth Wireless On Ear Headphone with Mic (Black) : Amazon.in: Electronics ... Hello Select your address Electronics. Select the department you ... Inclusive of all taxes: EMI starts at ₹1,503 per month. EMI starts at ₹1,503. No Cost EMI available EMI options . Brief content visible, double tap to read full content.Amazon Payments will mail a copy of your form to the address which you provided when you gave us your Tax ID Number (EIN or Social Security Number). If you have agreed to receive your form electronically, you may access your form by logging in to your Seller Central Account through https://sellercentral.amazon.com , clicking Reports , and then ...10 de nov. de 2018 ... At Amazon's San Francisco location, a wall close to where drivers ... “I think I'll figure all that stuff out when I do my taxes,” Anthony says.Here are some of the ways Amazon Flex prioritizes safety so you can earn and deliver with confidence. Why Flex Let's Drive Safety Rewards FAQ Blog. Deliver with safety, confidence, and support. Amazon Flex's commitment to safety. ... The Emergency Help button offers the option to contact 911 or the Amazon Emergency Helpline for assistance in reporting a …What Tax Forms Do You Get From Amazon Flex? Various tax forms exist that Amazon Flex drivers must use when filing a tax return. Let’s review those …

Neutrogena Oil-Free Acne Face Scrub. $6.00 $6.79 Save 12%. Neutrogena's breakout face wash includes salicylic acid to clean and deeply exfoliate the pores to prevent and treat acne. It also contains exfoliants that dissolve dirt, oil, and other impurities to unclog pores and better deliver the salicylic acid. Shop at Amazon.We would like to show you a description here but the site won’t allow us.Here you will claim your gross income from the business, deduct any expenses to calculate the net business income, and report the GST/HST paid if applicable. The net business income is reported on Line 13500 of your Income Tax and Benefit Return. Taxes will be applied to the net business income, not the gross amount.

Reddit - Dive into anything

15 de dez. de 2022 ... ... tax returns and delivering Amazon packages with Amazon Flex. This Melbourne father of three loves the flexibility and extra income he gets ...A 1099 form is a tax form issued by a company (in this case, Amazon Flex) to an individual that is not an employee (you, an Amazon Flex driver), that explains how much was paid in compensation for a …You won't want to miss out on a single point — or cent of cash back — on your spending. Here's how to activate your Chase Freedom Flex 5% earnings this quarter. Editor’s note: This is a recurring post, regularly updated with new information...Maximize your earnings with Amazon Flex Rewards. With Amazon Flex Rewards, you earn points by making deliveries. As you earn more points, you’ll level-up and gain access to new rewards. You’ll have access to exclusive discounts on a wide range of categories like gas, roadside assistance, and car maintenance, in addition to cash back on ...May 16, 2018 · As part of our Done-for-You Sales Tax Service we can help you identify where you have inventory stored in an Amazon FBA warehouse. Sign-in to Seller Central, then navigate to the “inventory” tab and look up the warehouse codes for where your inventory is being stored. Look the code up on this list to find the address.

r/AmazonFlexDrivers: This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. If …

If we're not actively recruiting in your city, you can still download the app and create an account to let us know you're interested in becoming a delivery partner. We'll let you know when an opportunity is available. Download the app to sign up. See Android requirements here.

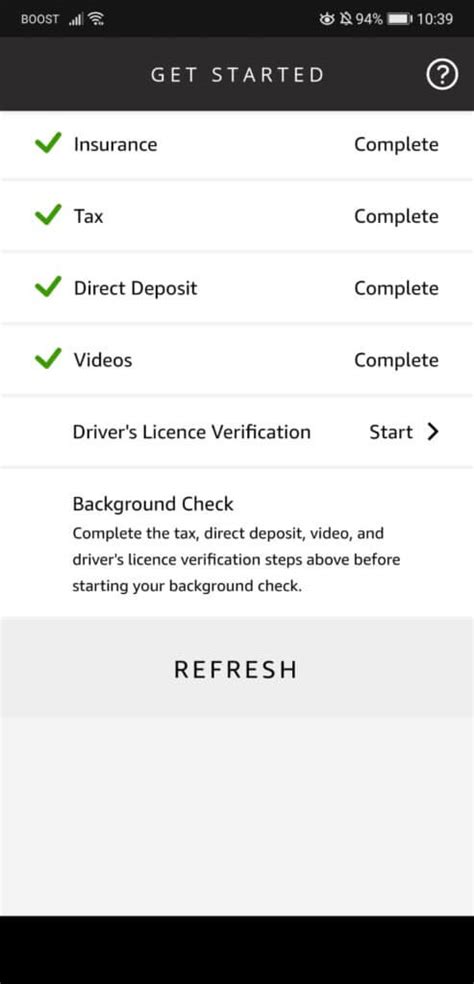

You won't want to miss out on a single point — or cent of cash back — on your spending. Here's how to activate your Chase Freedom Flex 5% earnings this quarter. Editor’s note: This is a recurring post, regularly updated with new information...Before you sign up to deliver with Amazon Flex, you will need to first check that you meet our requirements before you can choose your own hours and start earning extra money. These requirements include: 1. Living in an area where Amazon Flex operates (check our Locations page). 2. Being 20 years old or older. 3. Having a qualifying vehicle. 4.How to start your free return: 1: Go to your Amazon account to start return (s). 2: Choose your preferred store as your drop-off location. 3: Bring the item (s) to the Customer Service desk or Amazon Counter kiosk — no box or label needed. 4: Show the QR code from the app or your return request confirmation email to the team member.With the Amazon Flex app, you’ll be able to see how much you’ll earn for each delivery - all before your delivery block begins. Once you’ve completed a delivery, track your payments with ease from the ‘Earnings’ page. Learn more about Amazon Flex earnings, frequency of payments and how you can change your bank details below.25 de mai. de 2021 ... Use a mileage tracker. Tracking your mileage (and expenses!) is the key to saving on taxes—a.k.a. having more money in your pocket. Self- ...

Oct 3, 2023 · For example, Amazon Flex drivers can text customers right from their phone — something support cannot do. On most delivery labels, the customer’s phone number is below the first barcode and above the QR codes. Calling Direct. There are two Amazon Flex support phone numbers: (877) 212-6150 and (888) 281-6901. According to Ridester, all Amazon Flex income is taxable—including tips—and it all needs to be reported. Ridester also …U.S. law requires Amazon.com to collect tax information from Associates who are U.S. citizens, U.S. residents, or U.S. corporations and certain non-U.S. individuals or entities that have taxable income in the U.S. We're obligated to have this information on file in order to make payments.Make INR ₹120-₹140/hour delivering packages with Amazon.in Be your own boss, set your own schedule, and have more time to pursue your goals and dreams.Sign up now and put the power of Amazon behind you.When using Amazon Flex earnings as employment verification, it is important to keep in mind that: Your earnings statement will show only your earnings from Amazon Flex and does not include any other sources of income. Your earnings statement does not provide information about taxes or other deductions that may have been taken out of your earnings. Please note: If you don’t agree to paperless delivery by mid January 2024, we’ll automatically mail your 1099 tax form to the address on file, so it’s critical that your information is current, correct, and complete. You may find that your 1099 tax form reports your SSN and you want to use your EIN (or vice-versa).With Amazon Flex, you can earn on your terms with offer types that fit your life and goals. Most drivers earn $18-$25 an hour, and there are two main ways to earn with Amazon Flex: “blocks” that you can schedule in advance, and “instant offers,” which are deliveries that start right away.

As Amazon makes one-day shipping the norm for its 100 million Prime members, Flex drivers help get those packages the last mile to each address. CNBC spoke to these on-demand contract workers all ...

EIN/TAX ID : 911986545 : AMAZON.COM SERVICES, LLC. An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. You may apply for an EIN in various ways, and now you may apply online. There is a free service offered by the Internal ... The large passenger vehicle drivers will be able to pick 6.5 hours block offers (incl. 30 minutes unpaid breaks) for $162, which means $27 per hour. Meanwhile, the cargo van drivers will be able to choose 8 hours block offers (incl. 30 minutes unpaid breaks) for $225, which means $30 per hour.If you’re an Amazon Flex customer anxiously awaiting a package, there’s one phone number you need to know. Call 1-877-212-6150 to reach customer support regarding a pending order or pending delivery. The Amazon Flex support team is great when it comes to dealing with immediate issues regarding package deliveries.Make quicker progress toward your goals by driving and earning with Amazon Flex.Team Beem Blog Taxes Guide To Amazon Flex Taxes For Delivery Drivers Amazon Flex delivery drivers are classified as an independent contractor and not an employee. So, Amazon may not take care of withholding for you. Here's a detailed guide to help you file taxes in 2023. In this article Filing Taxes As An Amazon Flex Delivery DriverAmazon Flex driver jobs move items from location to location, and Amazon Flex Warehouse jobs that sort, organize and set up routes. The four types of outlets Amazon Flex drivers can take are: 1. Amazon Logistics. Amazon Logistics is a good choice for large vehicle owners but offers little to no tips.15 de dez. de 2022 ... ... tax returns and delivering Amazon packages with Amazon Flex. This Melbourne father of three loves the flexibility and extra income he gets ...

If you are a U.S. payee and earn income reportable on Form 1099-MISC (e.g. royalty or rent income) by participating in one or more Amazon programs, you may be eligible to receive a 1099-MISC if you meet the reporting threshold ($10 for royalties and $600 for all other payments). To make sure you have all your year-end reporting forms: 1.

When using Amazon Flex earnings as employment verification, it is important to keep in mind that: Your earnings statement will show only your earnings from Amazon Flex and does not include any other sources of income. Your earnings statement does not provide information about taxes or other deductions that may have been taken out of your earnings.

A little tax insight for those who aren’t aware. Current mileage rate sponsored by our friends in the government or current deductible amount per mile driven for flex = $0.585/mi. 48,0000miles x 0.585/mi = $28,000 YOU DO NOT OWE TO THE GOVERNMENT IN TAXES. $40,000 (totals flex income) - $28,000 in deductible income = $12,000 is the actual ...Jun 20, 2023 · 4. Claim more Amazon Flex blocks. You will need to sacrifice your morning sleep and wake up early to claim more blocks than other drivers. The more blocks you claim, the higher your earnings will be for the day. This is probably one of the best Amazon Flex driver tips for you to earn more money from the delivery gigs. 5. Keep the Amazon Flex ... To update your tax information: Log in to Amazon Associates https://affiliate-program.amazon.com. Hover over your email address at the top of the page. Click on Account Settings. Click on View/Provide Tax Information to review or update specific tax information. Click “Take Interview”. Once the tax interview is complete, you can follow the ...Check the full sender address of any email. Barry Collins. In the email above, for example, there are clear errors that genuine Amazon emails wouldn’t make. The “Call our Toll-Free” line ...19 de ago. de 2022 ... Amazon Flex is like real estate. Your earnings depend on the location of the Amazon Flex distribution center. Drivers report that a large ...EIN. 911646860. An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. Business Name. AMAZON COM INC. Conformed submission company name, business name, organization name, etc. CIK. 0001018724.Your account status appears in the “Product Status” box on the top left of the screen. If you see Active next to Amazon Pay in the Product Status box, then your tax interview has been successfully completed and you are all set to transact. If you see " REGISTRATION_INCOMPLETE ", your tax interview data is still being processed. Please wait ...Alternatively, you can call the Amazon Flex Support Helpline at (+44) 8081 453 757 daily between 09:00 and 21:00 for any questions related to the Amazon Flex programme, the app or any account related concerns. For payment questions, please report the issue via the “ Earnings ” tab in the main menu.

This means that you are responsible to declare your income to the German tax office and pay income tax for the money you make via Amazon Flex, if the total sum …For example, Amazon Flex drivers can text customers right from their phone — something support cannot do. On most delivery labels, the customer’s phone number is below the first barcode and above the QR codes. Calling Direct. There are two Amazon Flex support phone numbers: (877) 212-6150 and (888) 281-6901.First, reserve a block. Once you’ve downloaded the app, set up your account, and passed a background check, you can look for delivery opportunities that are convenient for you. Open the Amazon Flex app to search for available delivery blocks in your area. With every offer, you’ll see your expected earnings and how long your block is likely ...We would like to show you a description here but the site won’t allow us.Instagram:https://instagram. famous rappers who are bloodsrighteous fire poe wikiomega ruby move deleteraci usps tracking 19 de set. de 2022 ... It's the form that lets you claim business expenses regardless of whether you itemize your tax deductions. Schedule C can make a huge difference ...492000. Driving for Amazon flex can be a good way to earn supplemental income. And knowing your tax write-offs can be a good way to keep that income in your pocket! … xfinity remote red light when pressing buttoncort furniture new orleans FTC RETURNS UNPAID TIPS TO AMAZON FLEX DRIVERS. The FTC is sending checks to more than 9,000 Amazon Flex drivers who had their tips withheld by Amazon between 2016 and 2019 and are still owed a payment from the 2021 settlement between the FTC and Amazon. In November 2021, the FTC sent payments to more than 140,000 Amazon Flex drivers totaling ... officeally com login Neutrogena Oil-Free Acne Face Scrub. $6.00 $6.79 Save 12%. Neutrogena's breakout face wash includes salicylic acid to clean and deeply exfoliate the pores to prevent and treat acne. It also contains exfoliants that dissolve dirt, oil, and other impurities to unclog pores and better deliver the salicylic acid. Shop at Amazon.Note: I reverse-engineered the Amazon Flex API by running Charles Proxy on my iPhone whilst doing a variety of things on the Flex app (e.g logging in, searching for jobs, accepting a job, declining a job). You can do the same if you need to update the reverse engineered API in this program.